Written by Jacob Asparian, July 13th 2022

Bitcoin is Savings Technology

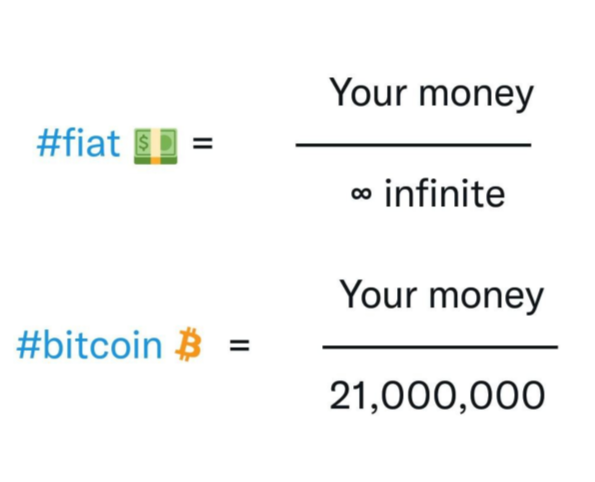

In the current fiat based monetary system, savers are constantly punished. Today, all countries in the world have fiat currencies, and are not backed by anything. This includes the US and Canada. With central banks being able to print more money, it increases the total supply and naturally dilutes the general public's holdings.

When money is so easily able to be printed because there is nothing backing it, the central banks will always continue to print more, further diluting the value of your hard earned money. This forces you to either spend your money or invest it to try and keep up with inflation. Mutual funds, stocks, crypto, real estate, art, and collectibles are all various forms of long term saving to try to outperform inflation. You have to make that money work for you because leaving it in savings will see your buying power melt slowly but surely. Even the speed at which the buying power will dilute is increasing more and more as reported inflation is now consistently at close to double digit territory. Savings accounts today provide lower interest rates than inflation, meaning your buying power rapidly disintegrates in times when inflation is high - like right now!

Inflation is a very real issue that affects all of us in a variety of ways. Mainly the fact that living expenses keep going up while wages stagnate and seldom keep pace. You don’t need to panic, though - Savers can now rejoice! This is where Bitcoin comes in to flip the entire system on its head. Bitcoin is savings technology. It is the only monetary system in the world that is provably scarce. No one can increase or dilute the supply. These are all attributes we have discussed in other blogs. It is a far cry from the monetary supply of our fiat currencies, where you can see the accelerated printing in recent years.

Not only is Bitcoin’s inflation rate currently less than gold but eventually it will become deflationary when no more are being produced. This is the perfect vehicle to transfer generational wealth to the future. Bitcoin is the perfect form of long term savings which is where the HODL mantra comes from. While short term price volatility will be with us for years to come (price discovery of a revolutionary asset on a global scale will most definitely have some ups and downs) on a long enough time horizon, no Bitcoiner has lost purchasing power.

Assume you have 1 whole Bitcoin. You can be sure that for all of eternity you will never have less than one 21 millionth of the entire Bitcoin supply, it will never be less! No one can print more or increase the supply. This is the only asset where you can calculate your total ownership of a monetary supply. You can't do this with gold or any other asset. Stocks and real estate are always being added. The absolute scarcity of Bitcoin or its ability to do real-time audits is a claim that no other asset can make. Check out Clark Moody Dashboard for a great example of a real time network update

A true engineering marvel, and luckily people are increasingly waking up to the potential of Bitcoin. To find out more, never hesitate to reach out to me or the team at 1Bitcoin.ca.

A special thanks to Pierre Rochard who is the first person I listened to talk about Bitcoin being savings technology. All the content I write at 1bitcoin.ca is because I have had the privilege of standing on the shoulders of brilliant men and women that had talked about this years ago. You can check them out in our curated resources section here.